Tucker Poling, JD, CPCU

General Counsel and Vice President of Claims

For over 40 years, the Kansas Health Care Stabilization Fund has been a critical safeguard for both healthcare providers and patients. Yet many providers don’t fully understand how it works or why it’s essential to maintaining a stable and affordable medical liability environment in Kansas. Here’s what you need to know.

What is the Fund?

The Kansas Healthcare Stabilization Fund (“Fund”) is an independent professional liability coverage fund created by the Kansas legislature, wholly funded by participating healthcare providers (not tax dollars), and governed by an 11-member Board of Governors. It provides a layer of professional liability coverage for healthcare providers who qualify for Fund coverage. Providers who qualify for Fund coverage also enjoy legal protections unavailable to non-qualifying healthcare providers.

Why Does the Fund Exist?

The Fund was established at the height of the medical malpractice liability crisis in the late 1970s and 80s as part of an effort to stabilize the Kansas healthcare environment.

The intent of creating the Fund was two-fold:

- Ensure healthcare providers have reasonable access to adequate liability insurance coverage so that patients can have access to care.

- Provide a guaranteed source of monetary recovery in the event a patient is injured due to malpractice.

How Does the Fund Support a Stable Kansas Healthcare Environment?

The legislature implemented a package of key policies as part of the Kansas Health Care Provider Insurance Availability Act and updates to that act, including, critically, establishing the Kansas Healthcare Stabilization Fund.

The package of policies included:

- Mandatory Liability Coverage: All qualified healthcare providers must carry a defined minimum amount of liability insurance coverage.

- A Layer of Financial Protection: An independent fund that provides one of the layers of the required amount of professional liability coverage.

- Guaranteed Access to Insurance: The Kansas Health Care Providers Insurance Availability Plan ensures that every qualified healthcare provider in Kansas has access to liability insurance, even if the provider is unable to receive insurance in the private market.

- Limits on Non-Economic Damages: A statutory cap on non-economic damages in malpractice lawsuits intended to help maintain stability in the liability system.

What Liability Coverage is Provided to Qualified Healthcare Providers Under the Fund?

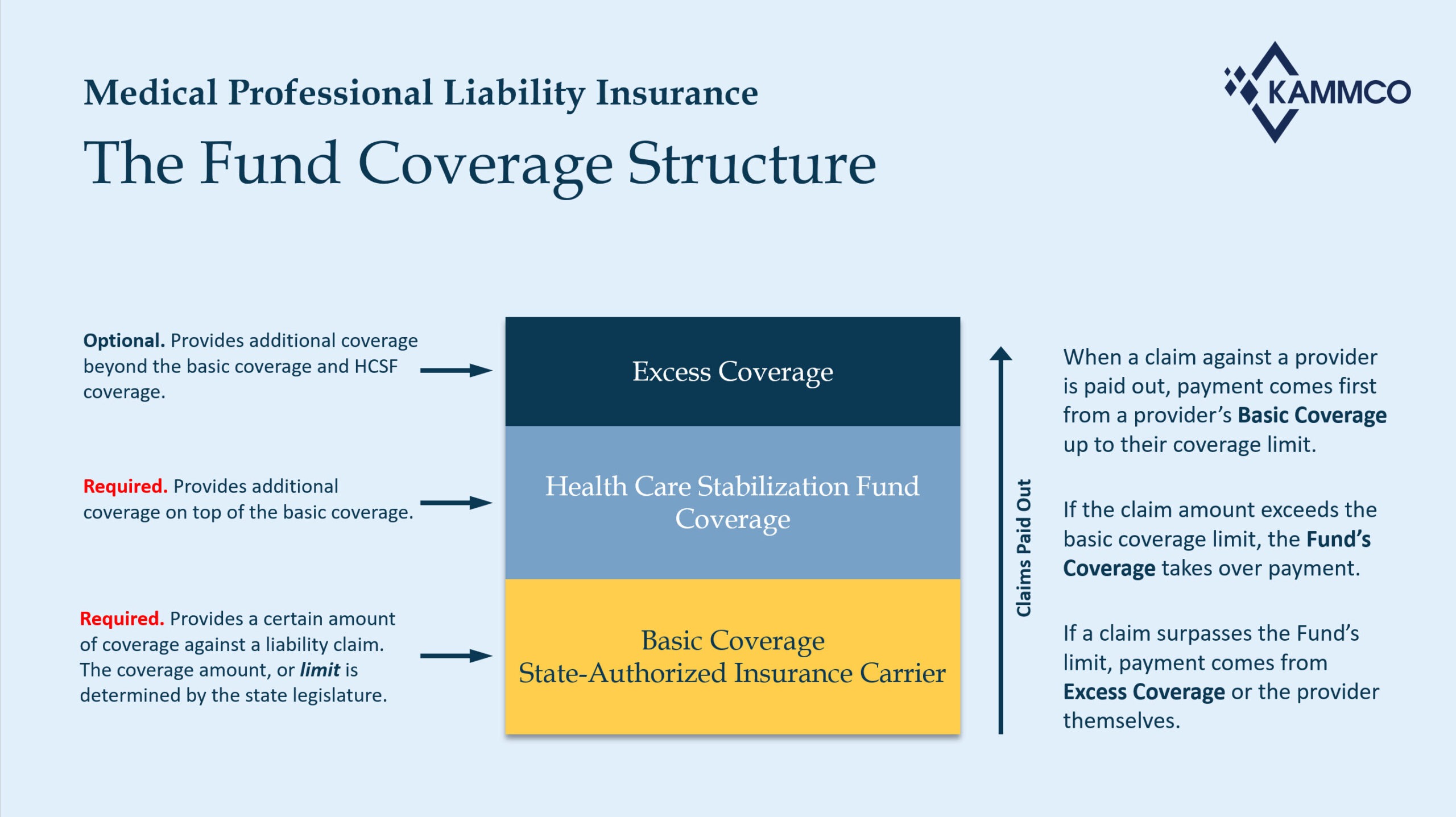

In most cases, the Fund provides a layer of coverage (usually $500,000) that is activated when a malpractice liability settlement or judgment exceeds the basic private malpractice liability coverage (usually $500,000) maintained by a provider. Additional information about Fund coverage can be found here.

Additional Benefits of Fund Coverage for Qualifying Healthcare Providers.

Legal Protections

Providers covered under the Fund cannot be held liable “for any injury or death arising out of the rendering of or the failure to render professional services inside or outside this state by any other healthcare provider who is also qualified for coverage under the fund.” K.S.A. 40-3403(h). See Brown v. Trobough, 57 Kan. App. 2d 271, Syl. 1 (2019).

Guaranteed Access to Primary Liability Insurance

If a provider who qualifies for Fund coverage is denied coverage in the private commercial insurance market, they have access to primary liability coverage from the Kansas Healthcare Provider Insurance Availability Plan (“Plan”). This gives qualified Kansas providers the peace of mind that they will always have access to professional liability insurance if they choose to continue to practice in Kansas.

“Tail Coverage” After Leaving Practice at No Additional Cost

When a qualified healthcare provider stops actively practicing and cancels their private liability insurance coverage, they automatically receive continued “tail coverage” at no additional cost. This coverage protects them from new liability claims based on acts that occurred when the provider was actively practicing.

Which Providers Qualify for the Benefits of Fund Coverage?

The Fund extends coverage to a wide range of healthcare professionals and facilities, including:

- Physicians

- Chiropractors

- Physician Assistants

- Nurse-Midwives

- Nurse-Anesthetists

- Most Dentists

- Hospitals and most other licensed healthcare facilities

A complete list of qualifying providers can be found here.

Which Providers Do Not Currently Qualify for the Benefits of Fund Coverage?

Given the evolution of direct patient care roles that has occurred over the 40+ years since the Fund statute was first passed, the most notable exclusion from Fund participation today is Advanced Practice Registered Nurses (“APRNs”).

During the 2022 Session of the Kansas Legislature, the Nurse Practice Act was amended to broaden the scope of practice for APRNs. These amendments to the Act also required APRNs to maintain malpractice insurance coverage. However, the amendments did not update the Fund statute to allow APRNs to be included in the definition of “healthcare provider.”

Because APRNs currently remain excluded from the definition of “health care provider,” they do not qualify for the benefits of Fund coverage that other advanced practice professionals (such as Physician Assistants and Nurse Anesthetists) have. Further, neither they nor their employers enjoy the same legal protections limiting vicarious liability and other liability claims arising out of the actions of other healthcare providers. However, the Kansas legislature is currently considering a bill that would update the Fund statute to include APRNs as defined healthcare providers.

Has the Fund Succeeded in Helping to Stabilize the Kansas Healthcare Liability Environment?

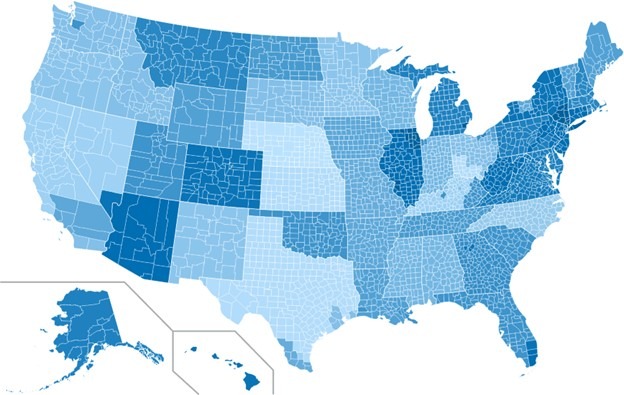

Yes. The Fund is a public/private partnership that achieves relative balance and stability in the market that reduces barriers to practice for healthcare providers and protects patients. The Fund is considered a model for successful state liability compensation funds, and it continues to deliver benefits for Kansas patients and providers. For example, the map below shows the differences between states in the average cost of liability insurance for primary care physicians. You can see that Kansas is better positioned than three of our four bordering states.

Only Nebraska edges Kansas out on this front. Notably, Nebraska also has a statutory liability coverage fund that is similar to our Fund. Nebraska has also implemented tort reform that includes a strong medical malpractice damages liability “hard cap” that limits both non-economic and economic damages in malpractice lawsuits.